Regardless of the retirement plans is, our advisors is explore the methods release collateral from your own home. Lives mortgages and you may equity discharge mortgages more than 55 are only a few alternatives.

Having a lives financial, you could launch finance tied of your house to invest as you wish on your later years decades, to make life hotter. For those approaching senior years, between the ages of 55 and you will 67, you have an appeal-merely home loan, whereby there may be a shortfall.

The lender may charge very early payment charges if you are using collateral discharge to settle a current financial. If that’s the way it is, our very own advisers could work along with you so you’re able to tally the entire pricing away from repaying an existing financial, just how much you’ll need obtain based on the property value your house along with your ages, and provide you with a good ballpark profile of what you could feel agreeing to blow along side title of your financing.

Since the identity off a lifetime financial ways, shortly after set up, it stays indeed there throughout your lifetime, continuously accruing focus. None of your own desire is actually payable by you, since it is repaid from the house. not, some business make it limited money to the an existence home loan, providing more mature consumers get-off a lot more about if you take financial command over the eye recharged.

The choices to repay something into a lives financial are completely elective and never a requirement; therefore, there’s not one responsibility while making continued appeal costs into remainder of your daily life. You certainly can do when you choose.

In all circumstances, 1st United kingdom will simply examine the essential legitimate lifestyle mortgages to have pensioners companies capable provide credible financial choices with the complete backing from a zero Bad Equity Guarantee.

The additional coverage of one’s Right out of Period means with the shared existence mortgages, the latest thriving partner are certain to manage to inhabit the property as the bank will not be able to force a-sale.

When you find yourself more than 55 yrs . old and interested in unlocking no less than ?ten,000 out of your home guarantee, correspond with the advisers during the initial British to find the very economically practical method of borrowing that’s true for you as well as your family.

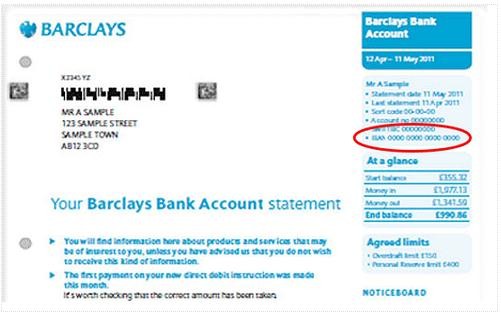

Why don’t we Begin: The HSBC Collateral Launch Opinion

very first British requires the latest guesswork off introducing equity from your own house. I evaluate the whole of the business, scrutinise this new terms and conditions and you can recommend with the all the you can easily methods of releasing collateral from your own home not only life mortgages. Find out how much we can make it easier to improve to fund retirement otherwise other things need cash to have.

Who happen to be HSBC Bank?

HSBC was a financial that procedures much more than just 140 places. Also they are one of many earth’s prominent loan providers, having overall possessions measured on $dos trillion, as reported by Forbes Journal within the 2019. Its well-known to utilize Equity To shop for More A residential property since the assets costs are nonetheless ascending in the united kingdom.

When the Equity Release can be helpful, Exactly why are Zero Financial institutions Providing it?

More effective and you will today’s most useful equity launch businesses are professionals during the old age functions. Domestic brands such as Legal & General and Aviva bring some security discharge issues customized towards more 55 age bracket.

Extremely loan providers offering guarantee release items are volunteer members of the fresh Security Discharge Council. When HSBC piloted the brand new HSBC Guarantee Get better Scheme, the new ERC went by Vessel, an acronym to own Safe Family Earnings Arrangements.

Which is while the been rebranded into the Guarantee Release Council and isn’t really only about bringing guarantee from your own home to fund pension. The money released compliment of security launch are used for any objective, and paying, and that many protected resident money do not allow.