The brand new double-finest trend functions as an excellent harbinger out of an impending bearish development. That it graph creation is visible in the event the industry attempts and you may fails to help you exceed a very high price level on the a couple independent times, signaling prospective exhaustion and you can recommending you to a reversal will get in the future capture place. Traders normally discover the new breaking of one’s neckline in order to verify so it trend ahead of investing ranks anticipating a down direction.

Holds, forex, and you can futures all of the benefit from the Rounding Finest Development, showing they beneficial across several financial locations. The brand new development is not being among the most profitable chart designs, as its slow development leads to not the case indicators. It stays a successful graph pattern when https://cinebuzztimes.com/song-all-locations/ affirmed from the frequency and you may most other indicators, providing highest-reward possibilities to have traders who perform trades with right exposure management. Unsuccessful malfunctions trigger reversals even though they try bearish, turning the new development for the optimistic graph habits in the event the help holds and you can speed motions higher. Buyers need to be mindful of incorrect malfunctions, playing with more signs for verification.

Wedge

The final solid bearish candle next confirms the new bearish reversal, signaling that the sellers took control of the market. The 3 external upwards trend is actually a professional laws of a potential optimistic reverse. It shows that the newest contains had been defeated, as well as the market is now poised to own a continual upward flow. So it trend is often seen at the bottom away from a great downtrend, signaling a possible change in market direction.

Certainly one of the strengths is its predictive precision, giving clear entryway points and you will structured exposure administration that have stop-loss position above recent highs. Diamond Patterns continue to be successful chart habits when conducted truthfully, as they aren’t one of the most winning chart models with the rareness. The increased hobby through the outbreaks advances reliability as the frequency confirmation is enhanced during the outbreaks.

- Filippo focuses on an educated Forex brokers for starters and you will benefits to assist buyers find the best change options because of their requires.

- Because the trend are confirmed, buyers can get lay sail to your a good bearish trip, led because of the a calculated speed address and you may a halt loss set over the most of the third peak.

- The fresh Ascending Scallop Pattern can be used inside the stocks, forex, and you may cryptocurrency segments.

- The newest double base indicators so you can potential people that inventory are that have a difficult time to make the new downs.

- Furthermore, really buyers will want multiple times of investigation before confirming any trend.

- The brand new Parabolic Contour Pattern is a technological chart formation that occurs whenever a valuable asset experience an abrupt and you may exponential rate improve, building a high up bend.

RSI and you can MACD are utilized by the investors when frequency verification is actually shorter reputable within the fx so you can examine outbreaks. The new trend’s reliability expands within the strong uptrends, as the energy can endure rate breakouts. The fresh Twice Best pattern try a highly-recognized bearish graph trend one to signals a keen uptrend’s prevent and you may an excellent downtrend’s beginning. Twice Best Trend versions if rates has reached a resistance height twice but does not crack highest, appearing a move inside industry sentiment from to purchase pressure to help you offering popularity. Buyers utilize the pattern can be expected price refuses and take short ranking accordingly. And you may, as the recalling all of the chart designs can be hugely challenging to possess specific people, a swindle sheet is an excellent and you may simple treatment for perform you to definitely, specifically at the beginning of your own trade journey.

Swing Change Signals

Time change habits can be improve your strategy from the letting you acceptance rate actions to make told behavior. Whether spotting development reversals, continuations, or impetus changes, these types of designs perform best whenever together with technology symptoms, regularity research, and you may chance administration. A bullish flag chart trend inside the trade is actually a technological chart trend one signals a probably boost in costs. It’s characterised by the a sharp countertrend (the fresh flag) you to definitely comes after a primary-resided development (the brand new pole). So it trend is similar to a banner that have masts for the both sides and you will are accompanied by a hefty rise in the new up assistance. The new breakout out of this pattern often leads to a robust move highest, calculating the duration of the last flag pole.

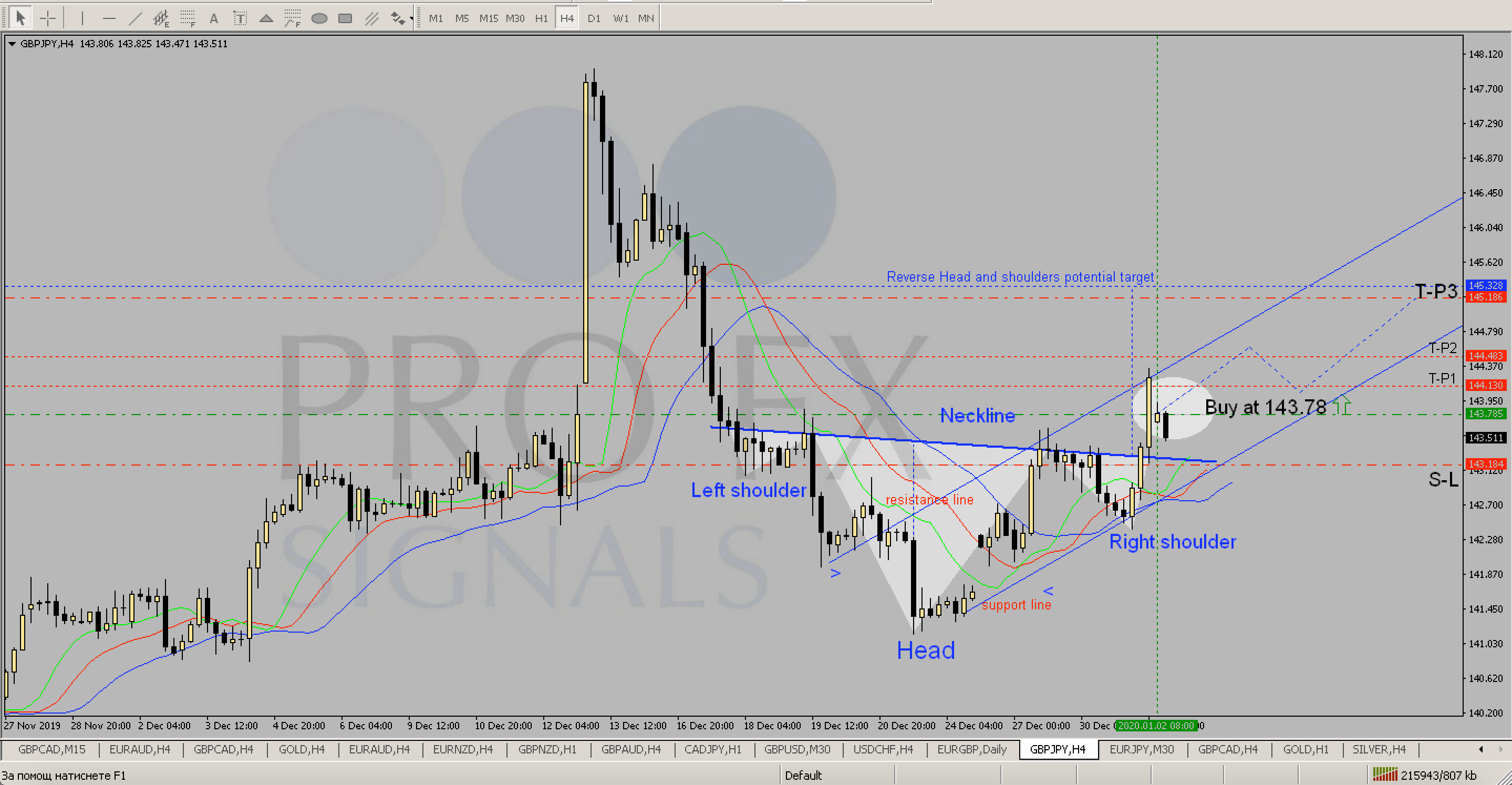

Although not, the brand new buyers still remain in manage complete during this integration several months. The fresh inverse direct and shoulders pattern is a development reverse creation, and this forecasts an uptrend turning into a good downtrend. The brand new inverse lead and shoulders contains three troughs, to your middle trough as being the reduced (the new ‘head’) as well as the two either corners are large and you will around equivalent (the’shoulders’). Dr. Andrew Lo and you may Jasmina Hasanhodzic’s 2009 study, “Do we Discover ways to Time Reversals?

- Sooner or later an excellent sell imbalance forms and you can price holidays off to the fresh disadvantage continuing the newest development.

- Unlike long-term buyers, time investors romantic all positions before the market comes to an end, to stop right away risks.

- An early morning superstar doji trend is a bullish reverse trend one to provides around three candle lights.

- Rounding Better Pattern variations a good You-formed curve turned upside-down, proving a reduced transition from good to purchase impetus in order to increasing promoting pressure.

What is actually a fantastic Get across Stock Trend?

The new graph and scratches an excellent “take profit variety” at the top quality for the projected disperse. People is also consider closing their ranking in this range to help you secure profits. As well, internal formations such as “inner highest levels” and you can “twice base on the trendline help” provide then knowledge to your possible breakout tips and you can energy. To possess twice tops, MACD crossing beneath the signal range validates the brand new development. A descending stairs development is recognized as an extension trend, signaling the prior downtrend can persist. Yet not, it’s also important to view for signs of reverse, such as optimistic divergence or some slack of one’s pattern, which could rule the start of an enthusiastic uptrend.

Technical analysts analysis such models to spot to buy opportunities and you can anticipate upcoming upward impetus inside a stock. The brand new per week and you will monthly maps are too enough time, and you was stuck inside a burning trade to possess an enthusiastic extended months looking forward to a period to complete. The fresh each day chart has the finest mix of capturing tradable swings and you can designs, while keeping exposure contains for the were not successful signals.

The brand new banner stands for a pause in the downtrend as the certain small-identity people get profits. Yet not, complete sentiment remains bearish, and more than traders invited straight down rates following this short-term integration. The fresh bullish banner is actually a continuation development you to definitely versions whenever rates consolidates inside a downward sloping station after the a powerful right up disperse. The newest bullish flag includes a sharp escalation in rates followed because of the an integration period where the rate movements sideways within the a great strict diversity, resembling a banner on the chart.

Yet not, all round negative sentiment continues to be principal in the business, and that short-term rally fails easily as the forces of your prevalent downtrend control again. So it construction shows consolidated trade pastime confined between service and you may opposition trendlines. To create a funnel, you have to hook up atleast a couple speed items that try responding to the newest trendline help and you will resistance.

The cost varies between your channel limits, enabling investors to put admission and hop out things. Small ranking is started close opposition, if you are prospective get indicators emerge should your speed holidays a lot more than resistance, signaling a trend reversal. Enhanced exchange frequency throughout the breakouts improves the newest pattern’s precision. The brand new development isn’t considered probably one of the most winning chart patterns, nevertheless Ascending Route Trend is highly effective in good uptrends whenever combined with correct chance management.

Not true outbreaks inside the chart models

A good Descending Triangle pattern is an excellent bearish continuation pattern characterized by a flat straight down service range and you can a low-sloping upper resistance range you to gather because the pattern expands. It usually variations throughout the an excellent downtrend as the vendors getting much more aggressive when you are buyers remain consistent during the a particular price top. An ascending Triangle are a bullish continuation development described as an excellent horizontal resistance line and you will a rising trendline. The new development variations as the speed produces high lows when you are repeatedly research the new resistance height. To increase the precision from my personal pattern identification, I blend graph designs which have technical indicators.

Do you know the benefits and drawbacks away from trading and investing patterns?

Yet not, if you would like stay correct to your development pursuing the means, you’ll be able to pick for the wonderful get across and sell on the demise mix. The fresh fantastic mix is a little as opposed to a few of the chart habits we’ve stated previously for the reason that it takes a few moving averages. Indeed, you might nearly change instead of candle lights with this particular chart pattern, whether or not we do not strongly recommend doing one.