Starting a service involves numerous vital actions, with incorporation being among one of the most considerable milestones for business owners aiming to establish an official company entity. One important item of this process is understanding ‘What are Articles of Consolidation?’ and the critical role they play in developing a company.

Filing this document with the ideal state authority not only establishes your service as a legal entity but likewise sets the structure for its long-term operation and integrity. This guide will certainly stroll you with everything you need to find out about Articles of Unification, including their meaning, benefits, filing procedure, and following actions to make certain conformity.

What are Articles of Consolidation?

The Articles of Consolidation, also referred to as a Certificate of Unification in some states, is an official lawful paper called for to produce a firm, outlining the essential information called for to lawfully develop the business.At site New Mexico Articles of Incorporation from Our Articles

To provide the short articles of consolidation definition, these records include critical info such as the firm’s name, purpose, registered representative, and the variety of shares accredited.

It functions as the structure for the firm’s legal presence, giving necessary information regarding the business structure and operations.

Articles of Consolidation definition

At its core, the Articles of Incorporation work as the ‘birth certificate’ of a company. When submitted with the state, this record officially creates the corporation, providing it legal recognition. Each state has its very own needs, yet the Articles usually consist of info such as the firm’s name, purpose, and signed up agent details.

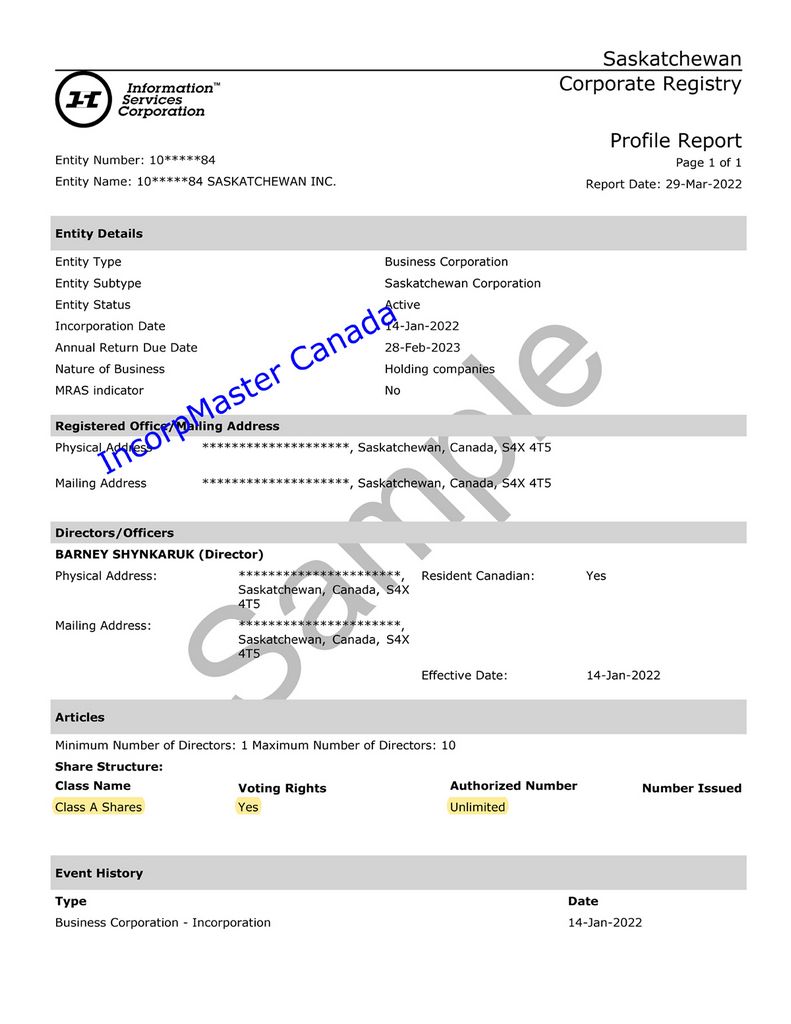

Instance of Articles of Unification

Below is an instance of Articles of Incorporation (also described as a Certificate of Unification in Delaware), which responds to the inquiry ‘what do write-ups of incorporation resemble’ and is a paper called for by the state to establish a firm.

This file is split into six essential areas:

- Call: Defines the main name of the corporation.

- Registered workplace and Registered representative: Checklists the address of the firm’s registered office and the registered representative accredited to receive lawful files.

- Objective: Defines the function or objectives of the company.

- Stock info: Details the authorized amount of supply the firm can issue.

- Incorporator information: Includes the name and mailing address of the individual responsible for filing the file.

- Signature: The witnessed section, where the incorporator formally authorizes the record.

Each section offers a critical duty in legitimately specifying the company’s existence and framework.

Advantages of filing Articles of Incorporation

Declaring Articles of Consolidation opens the door to numerous crucial benefits for your company:

Personal asset security

One of the leading factors business owners incorporate is to secure their personal assets. Filing Articles of Consolidation develops a clear boundary between your personal and organization liabilities.

If your company faces financial obligations or lawful concerns, your personal effects, like your home or savings, typically stays secure. This defense is invaluable, particularly in industries susceptible to dangers or claims.

Unique rights to company name

When you integrate, your service name is registered with the state, guaranteeing that no other corporation in the very same state can make use of the exact same name. This offers a degree of exclusivity and shields your brand name identity within that jurisdiction.

Nonetheless, it is very important to note that this security is usually restricted to the state where you include. If you desire broader protection, such as across the country exclusivity, you may require to register your service name as a hallmark with the united state Patent and Hallmark Workplace (USPTO).

Possible tax obligation advantages

Although companies are strained in different ways from single proprietorships or collaborations, they can benefit from specific tax obligation benefits. Relying on the framework (such as C firm or S company), you may minimize overall tax obligation responsibility, keep incomes within business, or deduct expenses like fringe benefit.

Improved company credibility

A bundled company brings even more weight in the eyes of consumers, vendors, and capitalists. The ‘Inc.’ or ‘Corp.’ at the end of your firm name signals stability, professionalism and reliability, and long-term dedication. This can assist draw in customers and strengthen your online reputation in your sector.

In addition, several companies and federal government entities prefer to work with incorporated organizations, opening doors to larger agreements or partnerships.

What to consist of in the Post of Incorporation?

When preparing your Articles of Consolidation, right here’s the vital info you’ll need to consist of:

- Firm’s name: The official lawful name of your organization.

- Organization function: Either a general function or a details one customized to your operations.

- Registered agent information: Call and deal with of the private or entity accredited to get lawful files in behalf of your company.

- Preliminary supervisors: Names and addresses of the people that will supervise the corporation.

- Number and types of shares: The number of shares the firm is authorized to issue and any kind of details regarding their courses.

- Duration of the firm: Whether the corporation is continuous or exists for a specific term.

- Firm address: The principal workplace address of the company.

- Type of corporation: For instance, C Company or S Corporation.

- Various stipulations (optional): Any extra information pertinent to your corporate operations, such as investor rights or electing treatments.

Exactly how to prepare Articles of Incorporation?

As soon as you comprehend ‘what is a short article of unification’, you can start drafting one for your business. Making use of a state-provided template can simplify the process and make certain every little thing is finished efficiently.

Step 1: Acquire your state’s design template

The majority of states offer a standardized Articles of Incorporation design template on their Secretary of State website.

To discover the design template:

- Visit your state’s Secretary of State or service enrollment website.

- Search for ‘Articles of Incorporation’ types.

- Download the proper design template for your firm kind (e.g., specialist firm, nonprofit, etc).

The template will normally include fields or sections for fundamental details like your firm’s name, address, and the name of your registered agent.

Step 2: Include custom-made provisions

Customized provisions are optional, but they can supply clearness and shield your service interests down the line. Some custom arrangements you may take into consideration adding include:

- Voting legal rights: Specify the voting civil liberties of investors, particularly if your firm will issue multiple classes of stock.

- Indemnification stipulation: Protect supervisors and policemans from individual responsibility for business actions.

- Period condition: State how long you want the corporation to exist, whether forever or for a specific period.

- Limitations (if any): Consist of conditions that limit particular tasks, such as limitations on moving shares.

Action 3: Send and submit your paper

As soon as your layout is full and personalized, it’s time to file it. A lot of states permit you to file Articles of Incorporation online, by mail, or face to face.

- Pay the declaring fee: Declaring fees vary by state however usually vary from $50 to $300.

- Preserve a copy: Maintain a duplicate of the completed record for your documents, as you’ll require it for jobs like opening up a service savings account or protecting a Company Identification Number (EIN).

When and where to file Articles of Incorporation?

Understanding when and where to submit, who is responsible for managing the process, and how much it costs can make the procedure seem less daunting.

When to file

The Articles of Unification are submitted throughout the initial phase of setting up a firm, right after selecting a service name, confirming its schedule, and picking a signed up agent to represent your business.

It’s important to file as quickly as you’re ready. Waiting also lengthy to submit might delay critical next steps, like opening a company checking account or acquiring a Company Identification Number (EIN) from the IRS.

Where to file

Articles of Incorporation are filed with the Secretary of State (or its comparable) in the state where you plan to run your firm.

Each state has its own workplace for business filings, which can generally be discovered on the state federal government’s website. Several states also provide on the internet declaring services, making it quicker and more convenient to finish the procedure.

Who prepare and file the Articles of Consolidation

The person responsible for preparing and submitting Articles of Incorporation is known as the ‘incorporator.’ This can be a local business owner, a company rep, or anybody assigned to deal with the documentation.

For included benefit and precision, you can employ the aid of a company attorney or an online consolidation solution. Trusted suppliers like BBCIncorp concentrate on browsing state-specific requirements and guaranteeing error-free filings, whether you’re including in Delaware or discovering overseas jurisdictions.

Declaring charges

The price to file Articles of Consolidation varies extensively by state, generally varying from $50 to $300. Added expenses might use if you utilize an attorney or an online service to prepare and file the documents.

Some states also charge a franchise business tax or call for an annual report after the first declaring, so it’s a good idea to budget for ongoing conformity costs.

What happens after filing Articles of Incorporation?

Declaring Articles of Unification is a major milestone in forming your firm, yet it’s just the start of your company’s legal and functional setup.

After your records are sent, there are numerous necessary actions to finish before your company is totally functional and in conformity with state demands.

- Produce laws: Bylaws help guarantee your corporation runs efficiently and stays compliant with state laws. They’re additionally frequently needed by banks or investors during due diligence.

- Hold preliminary investor and director conferences: As soon as you’ve drafted your company laws, it’s time to arrange a meeting to take on business laws, assign officers, and make preliminary choices.

- Acquire an EIN (Company Identification Number): You can apply for an EIN online via the IRS site. Authorization is typically prompt, so you can begin utilizing your EIN immediately for tax obligation and banking purposes.

- Safe and secure organization licenses or licenses: Check if your business calls for additional licenses to operate lawfully. and use as soon as possible to stay clear of charges or hold-ups.

- Preserve compliance: Meet ongoing state demands like annual filings or franchise business tax obligations.

Verdict

Composing and submitting Articles of Unification is a vital action toward establishing a legally acknowledged corporation. These papers don’t just secure your individual assets; they aid your company stand apart with unique advantages like name exclusivity and boosted credibility.

If you’re still questioning, ‘What are Articles of Consolidation and why do I need them?’, keep in mind that this foundational lawful file can thrust your business toward growth and success. When you’re ready to take the leap, get in touch with sources like BBCIncorp to enhance the process, conserving effort and time.